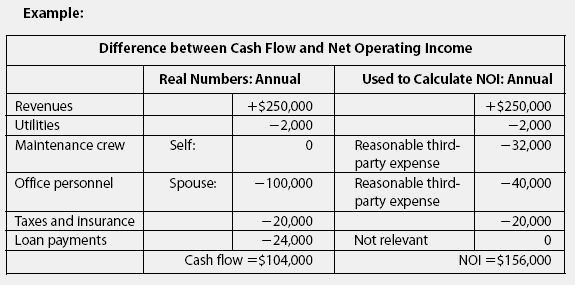

In an urban setting, to be of credible assistance in this process, comparable sales must have the same use as the subject, have many similarities to the subject in terms of size of house, size of lot, construction, bedroom count, room count, floor plan, amenities, street traffic and be in the same neighborhood and have been sold in the recent past (preferably no more than six months) by way of an "arms length" transaction (i.e., not sold to a relative or friend and not sold due to a forced sale or distress sale) and be within one mile of the subject property. The facts and details of the comparable properties will be compared to those of the subject. Comparable Sales: As part of the appraisal process, those relatively recently sold properties which will be compared to the subject property (the property being appraised) for the purpose of forming an opinion of value for the subject property.(See definition of "net operating income" below.) Cash Flow: The net operating income minus the total of all debt service payments.Carrying Charges: expenses necessary for holding property, such as taxes and interest on idle property or property under construction.Capitalization (Cap) Rate: rate of return used to derive the capital value of an income stream, divide annual income by net operating income.Capital Improvement: any structure or component erected as a permanent improvement to real property that adds to its value and useful life.Capital expenditures are appreciated over their useful life repairs are subtracted from income for the current year. The cost of repairing a property is not a capital expenditure. Capital Expenditure: the cost of an improvement made to extend the useful life of a property or to add to its value, such as adding a room.

Bundle of Rights: ownership in real property implies a group of rights, such as the right of occupancy, use and enjoyment, the right to sell in whole or in part, the right to control the use, the right to bequeath, the right to lease any or all of the rights, the right to the benefits derived by occupancy and use of the property, etc.Building Permit: permission granted by a local government or agency to build a specific structure at a specific site.Assessed Value: the value established for property tax purposes.Annual Rent: This is the annual gross rent received for the calendar year during the period from January 1st through December 31st.Addendum: something added as an attachment to a contract.

0 kommentar(er)

0 kommentar(er)